What Is A Short Vertical Spread . one example of a vertical spread is a bull put credit spreads, also known as short put spread. a short call vertical spread is a bearish position involving a short and long call with different strike prices in the same expiration. a vertical spread is an options trading strategy involving the simultaneous buying and selling of options of the same type (call or put). in a vertical spread, an individual simultaneously purchases one option and sells another (on the same underlying asset) at a higher strike. Bull puts spreads benefit when the underlying. A short put vertical spread consists of two.

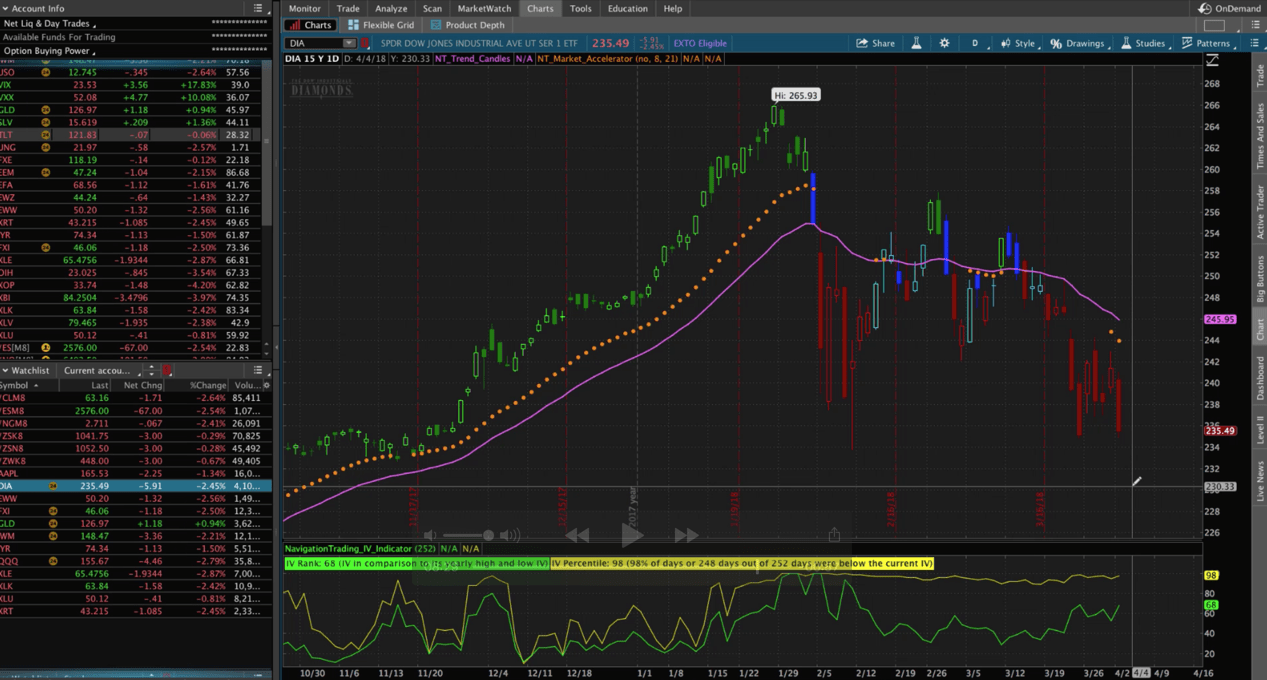

from navigationtrading.com

Bull puts spreads benefit when the underlying. a vertical spread is an options trading strategy involving the simultaneous buying and selling of options of the same type (call or put). in a vertical spread, an individual simultaneously purchases one option and sells another (on the same underlying asset) at a higher strike. A short put vertical spread consists of two. one example of a vertical spread is a bull put credit spreads, also known as short put spread. a short call vertical spread is a bearish position involving a short and long call with different strike prices in the same expiration.

How To Roll A Short Call Vertical Spread Navigation Trading

What Is A Short Vertical Spread a short call vertical spread is a bearish position involving a short and long call with different strike prices in the same expiration. a short call vertical spread is a bearish position involving a short and long call with different strike prices in the same expiration. Bull puts spreads benefit when the underlying. in a vertical spread, an individual simultaneously purchases one option and sells another (on the same underlying asset) at a higher strike. one example of a vertical spread is a bull put credit spreads, also known as short put spread. A short put vertical spread consists of two. a vertical spread is an options trading strategy involving the simultaneous buying and selling of options of the same type (call or put).

From navigationtrading.com

How To Roll A Short Call Vertical Spread Navigation Trading What Is A Short Vertical Spread A short put vertical spread consists of two. a vertical spread is an options trading strategy involving the simultaneous buying and selling of options of the same type (call or put). Bull puts spreads benefit when the underlying. one example of a vertical spread is a bull put credit spreads, also known as short put spread. a. What Is A Short Vertical Spread.

From optionalpha.com

How to Trade Vertical Spreads The Complete Guide What Is A Short Vertical Spread A short put vertical spread consists of two. in a vertical spread, an individual simultaneously purchases one option and sells another (on the same underlying asset) at a higher strike. a short call vertical spread is a bearish position involving a short and long call with different strike prices in the same expiration. Bull puts spreads benefit when. What Is A Short Vertical Spread.

From www.strike.money

Vertical Spreads What is it, How it Works, Types, Trading What Is A Short Vertical Spread A short put vertical spread consists of two. a vertical spread is an options trading strategy involving the simultaneous buying and selling of options of the same type (call or put). a short call vertical spread is a bearish position involving a short and long call with different strike prices in the same expiration. in a vertical. What Is A Short Vertical Spread.

From unofficed.com

Vertical Spread Learn about Vertical Spread Options Strategy Unofficed What Is A Short Vertical Spread in a vertical spread, an individual simultaneously purchases one option and sells another (on the same underlying asset) at a higher strike. one example of a vertical spread is a bull put credit spreads, also known as short put spread. Bull puts spreads benefit when the underlying. a vertical spread is an options trading strategy involving the. What Is A Short Vertical Spread.

From morrducimenrinnar.netlify.app

Point Spread 3 Way What Is A Short Vertical Spread Bull puts spreads benefit when the underlying. in a vertical spread, an individual simultaneously purchases one option and sells another (on the same underlying asset) at a higher strike. a vertical spread is an options trading strategy involving the simultaneous buying and selling of options of the same type (call or put). one example of a vertical. What Is A Short Vertical Spread.

From www.strike.money

Vertical Spreads What is it, How it Works, Types, Trading What Is A Short Vertical Spread a vertical spread is an options trading strategy involving the simultaneous buying and selling of options of the same type (call or put). one example of a vertical spread is a bull put credit spreads, also known as short put spread. in a vertical spread, an individual simultaneously purchases one option and sells another (on the same. What Is A Short Vertical Spread.

From www.randomwalktrading.com

Option Trading Strategies Random Walk Trading What Is A Short Vertical Spread a short call vertical spread is a bearish position involving a short and long call with different strike prices in the same expiration. in a vertical spread, an individual simultaneously purchases one option and sells another (on the same underlying asset) at a higher strike. Bull puts spreads benefit when the underlying. A short put vertical spread consists. What Is A Short Vertical Spread.

From www.youtube.com

Short Vertical Spreads Options Strategy Management YouTube What Is A Short Vertical Spread A short put vertical spread consists of two. a short call vertical spread is a bearish position involving a short and long call with different strike prices in the same expiration. Bull puts spreads benefit when the underlying. a vertical spread is an options trading strategy involving the simultaneous buying and selling of options of the same type. What Is A Short Vertical Spread.

From randomwalktrading.com

Vertical Spread Vertical Spread Vs Naked Option Options Trading What Is A Short Vertical Spread a vertical spread is an options trading strategy involving the simultaneous buying and selling of options of the same type (call or put). Bull puts spreads benefit when the underlying. one example of a vertical spread is a bull put credit spreads, also known as short put spread. in a vertical spread, an individual simultaneously purchases one. What Is A Short Vertical Spread.

From www.randomwalktrading.com

CH 7 Vertical Spread Random Walk Trading What Is A Short Vertical Spread a short call vertical spread is a bearish position involving a short and long call with different strike prices in the same expiration. a vertical spread is an options trading strategy involving the simultaneous buying and selling of options of the same type (call or put). one example of a vertical spread is a bull put credit. What Is A Short Vertical Spread.

From www.youtube.com

Bull Put Spread Guide Vertical Spread Option Strategies YouTube What Is A Short Vertical Spread one example of a vertical spread is a bull put credit spreads, also known as short put spread. A short put vertical spread consists of two. a short call vertical spread is a bearish position involving a short and long call with different strike prices in the same expiration. in a vertical spread, an individual simultaneously purchases. What Is A Short Vertical Spread.

From fabalabse.com

How to do bullish vertical spread? Leia aqui How do you calculate What Is A Short Vertical Spread Bull puts spreads benefit when the underlying. in a vertical spread, an individual simultaneously purchases one option and sells another (on the same underlying asset) at a higher strike. a vertical spread is an options trading strategy involving the simultaneous buying and selling of options of the same type (call or put). a short call vertical spread. What Is A Short Vertical Spread.

From www.tastylive.com

Vertical Spread What are Vertical Spread Options? tastylive What Is A Short Vertical Spread a short call vertical spread is a bearish position involving a short and long call with different strike prices in the same expiration. Bull puts spreads benefit when the underlying. a vertical spread is an options trading strategy involving the simultaneous buying and selling of options of the same type (call or put). in a vertical spread,. What Is A Short Vertical Spread.

From learninginvestmentwithjasoncai.com

Vertical Spreads Options Strategies Explained For Newbies A Simple What Is A Short Vertical Spread a vertical spread is an options trading strategy involving the simultaneous buying and selling of options of the same type (call or put). Bull puts spreads benefit when the underlying. A short put vertical spread consists of two. a short call vertical spread is a bearish position involving a short and long call with different strike prices in. What Is A Short Vertical Spread.

From www.tastylive.com

How to Manage Short Vertical Spreads tastylive What Is A Short Vertical Spread a short call vertical spread is a bearish position involving a short and long call with different strike prices in the same expiration. A short put vertical spread consists of two. one example of a vertical spread is a bull put credit spreads, also known as short put spread. in a vertical spread, an individual simultaneously purchases. What Is A Short Vertical Spread.

From optionclue.com

How to Buy and Sell Top Stock Options? Short Vertical Spread. Optionclue What Is A Short Vertical Spread one example of a vertical spread is a bull put credit spreads, also known as short put spread. Bull puts spreads benefit when the underlying. a short call vertical spread is a bearish position involving a short and long call with different strike prices in the same expiration. A short put vertical spread consists of two. in. What Is A Short Vertical Spread.

From workplace.schwab.com

Calculating Risk on Vertical Options Spreads Retirement Plan Services What Is A Short Vertical Spread a vertical spread is an options trading strategy involving the simultaneous buying and selling of options of the same type (call or put). Bull puts spreads benefit when the underlying. in a vertical spread, an individual simultaneously purchases one option and sells another (on the same underlying asset) at a higher strike. A short put vertical spread consists. What Is A Short Vertical Spread.

From www.youtube.com

The Vertical Spread Options Strategies (The ULTIMATE InDepth Guide What Is A Short Vertical Spread one example of a vertical spread is a bull put credit spreads, also known as short put spread. a vertical spread is an options trading strategy involving the simultaneous buying and selling of options of the same type (call or put). in a vertical spread, an individual simultaneously purchases one option and sells another (on the same. What Is A Short Vertical Spread.